Approach

A Personalized Approachfrom Crescent Pine Family Office Group

We are dedicated to a unique approach for high net worth individuals, centered on transparency, fiduciary duty, and a multi-custodial strategy.

We provide personalized private banking-level service, emphasizing responsiveness, proactive communication, accessibility, and a genuine commitment to addressing our clients’ needs and challenges.

Our transparent approach ensures you understand every financial aspect, backed by our fiduciary responsibility to act in your best interest. We safeguard your assets through a multi-custodial strategy, reducing risk and enhancing security.

Welcome to a new era of wealth management.

Independent 3rd Party Reporting (eMoney)

Your customized reports provide clarity on performance, cash flows, portfolio allocations, and fees.

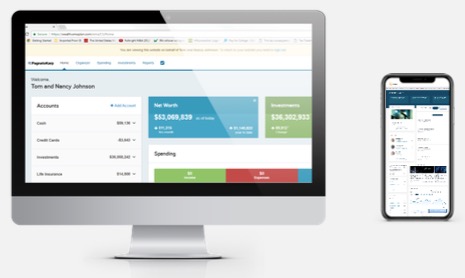

24-Hour Client Portal Access

- Online access that gives you transparency and live dashboards:

- Independent 3rd party reporting

- Performance reporting

- Account aggregation

Reporting Services

- Year-end tax reporting

- Customized reporting capabilities

- Financial statements

- Cash flow itemized by interest and dividend income

- All advisory fees disclosed

- 3rd Party reports from your custodian

Reviews

In-person or virtual reviews that include:

- Progress to plan

- Detailed portfolio performance across asset classes

- Market overview, including deep dives on current themes

Customized in-depth reviews for the services you receive:

- Planning

- Estate

- Tax

- Lifestyle

Market Overview

We dig deep so you don’t have to:

- Insights on what we are watching

- Market updates and commentary

- Benchmark trends

- News and highlights through Strategas

What to Expect In Your First YearWorking with Crescent Pine Family Office Group

0-3 Months

Goals-Based

Financial Planning

- Client onboarding with Multi-Custodial Access

- Facilitate transfer of “In Kind” Portfolio Assets

- Financial, tax, and portfolio modeling

- Create Investment policy statement

- Private Markets Access & Overview

3–9 months

Bi-Annual Financial Planning Check-Ins

- Investment performance review

- Near-term investment opportunities

- Access to private deal opportunities

- Year-end tax planning

- Treasury Cash management solutions for banking & lending

9–12 months

Annual Financial Plan Review & Reassessment

- Review long-term planning and action items

- Timely planning updates — legislation changes, market opportunities, etc.

- Philanthropic strategies & goals (charitable and personal)

- Review need for family governance and education support

We invite you to learn more about our personalized services and how our unique approach can create an elevated experience for yourself and your family.